how to calculate nj taxable wages

Also check your W-2 to confirm that New. New Jersey paycheck calculator Payroll Tax Salary Paycheck Calculator New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for.

Llc Tax Calculator Definitive Small Business Tax Estimator

Taxable Retirement Income.

. After a few seconds you will be provided with a full. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. Calculate your take home pay after federal new jersey taxes deductions and exemptions.

Your employer uses the information that you provided on your W-4 form to. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax.

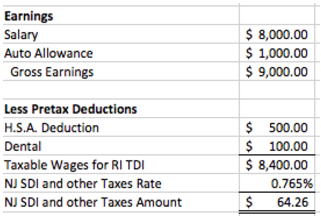

Here is the formula for calculating taxable wages. Your average tax rate is 1198 and your marginal. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for.

How Your New Jersey Paycheck Works. The New Jersey tax calculator is updated for the 202223 tax year. Round down if less than 0005.

The taxable wage base changes each year and is 28 times the statewide average weekly wage paid to workers subject to the law. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16.

Round up to the next cent if one-half cent 0005 or higher. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from. Enter your salary or wages then choose the frequency at which you are paid.

After the wage cap is met salary deductions. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income.

NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. The Commissioner of Labor and Workforce. Calculate the tax to the third decimal point.

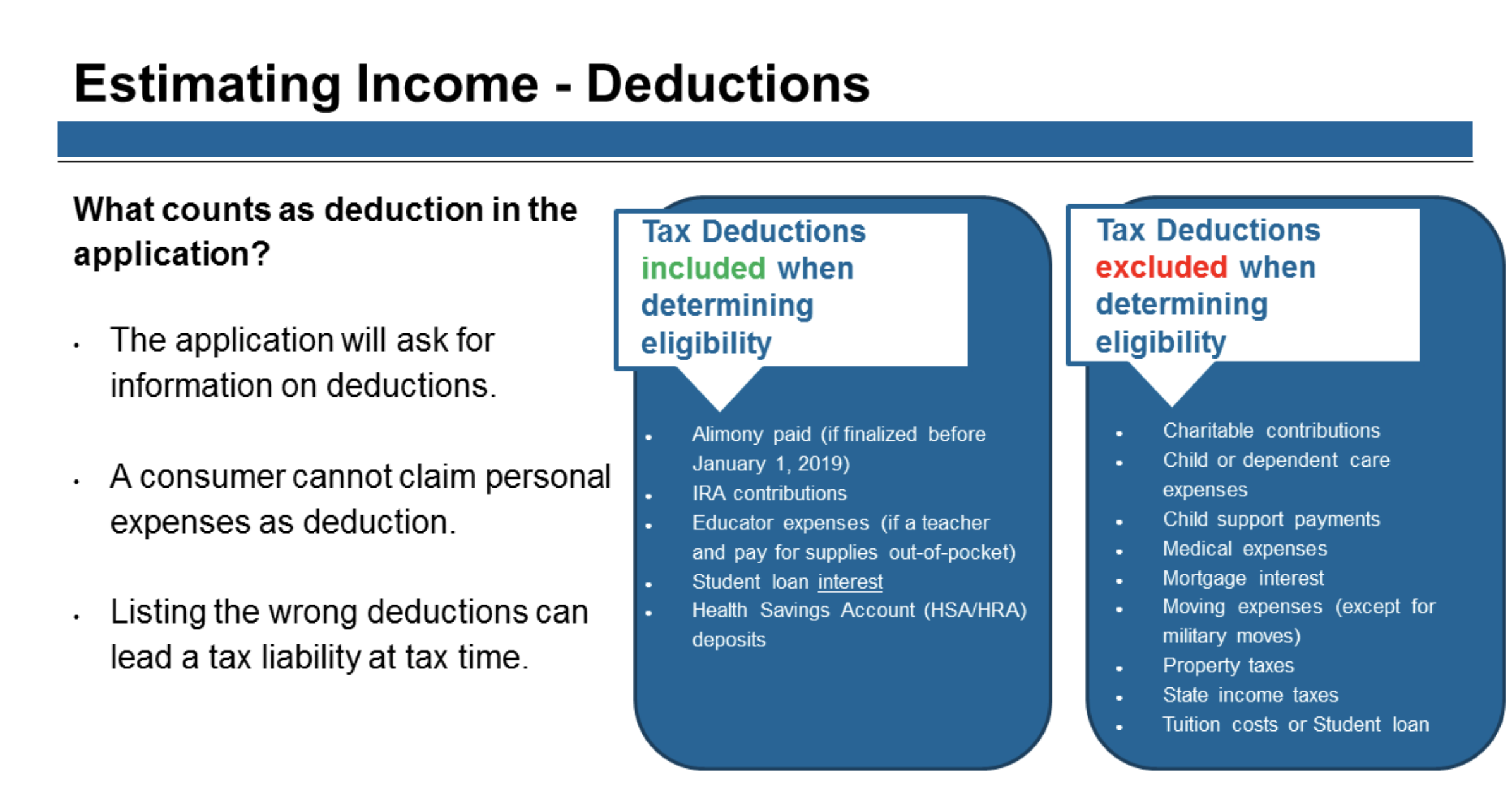

New Jersey Income Tax Calculator 2021 If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. See Tax Rate Tables to calculate your tax. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages The best payroll.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate. Federal income taxes are also withheld from each of your paychecks.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Solved I Received State Disability From New Jersey Is That Taxable I Do Not Have A 1099 G I Have A Form W 2 With Money On Number One For Wages

How Do State And Local Individual Income Taxes Work Tax Policy Center

Why Does Ny Tax My Nj Source Income When We Re Nj Residents

Payroll Software Solution For New Jersey Small Business

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Do You Calculate Income On New Jersey Insurance Marketplace Independent Health Agents

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Payroll Tax Calculator For Employers Gusto

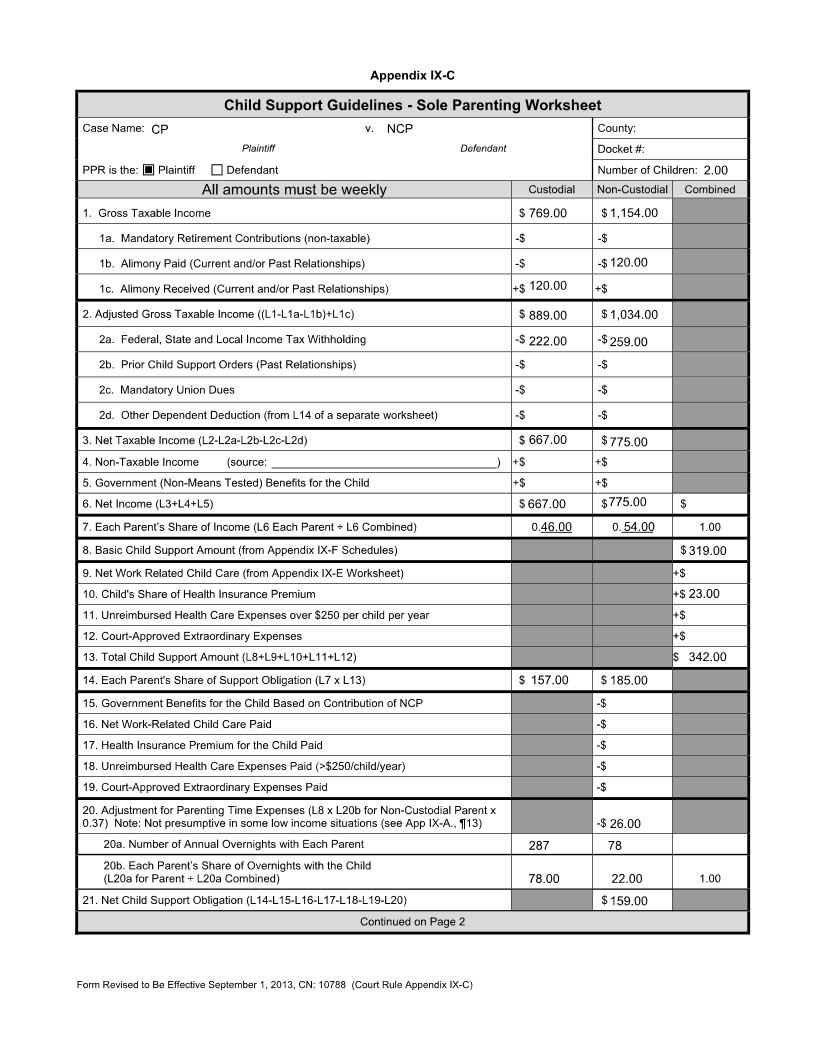

How Much Child Support Will I Pay In New Jersey

State Individual Income Tax Rates And Brackets Tax Foundation

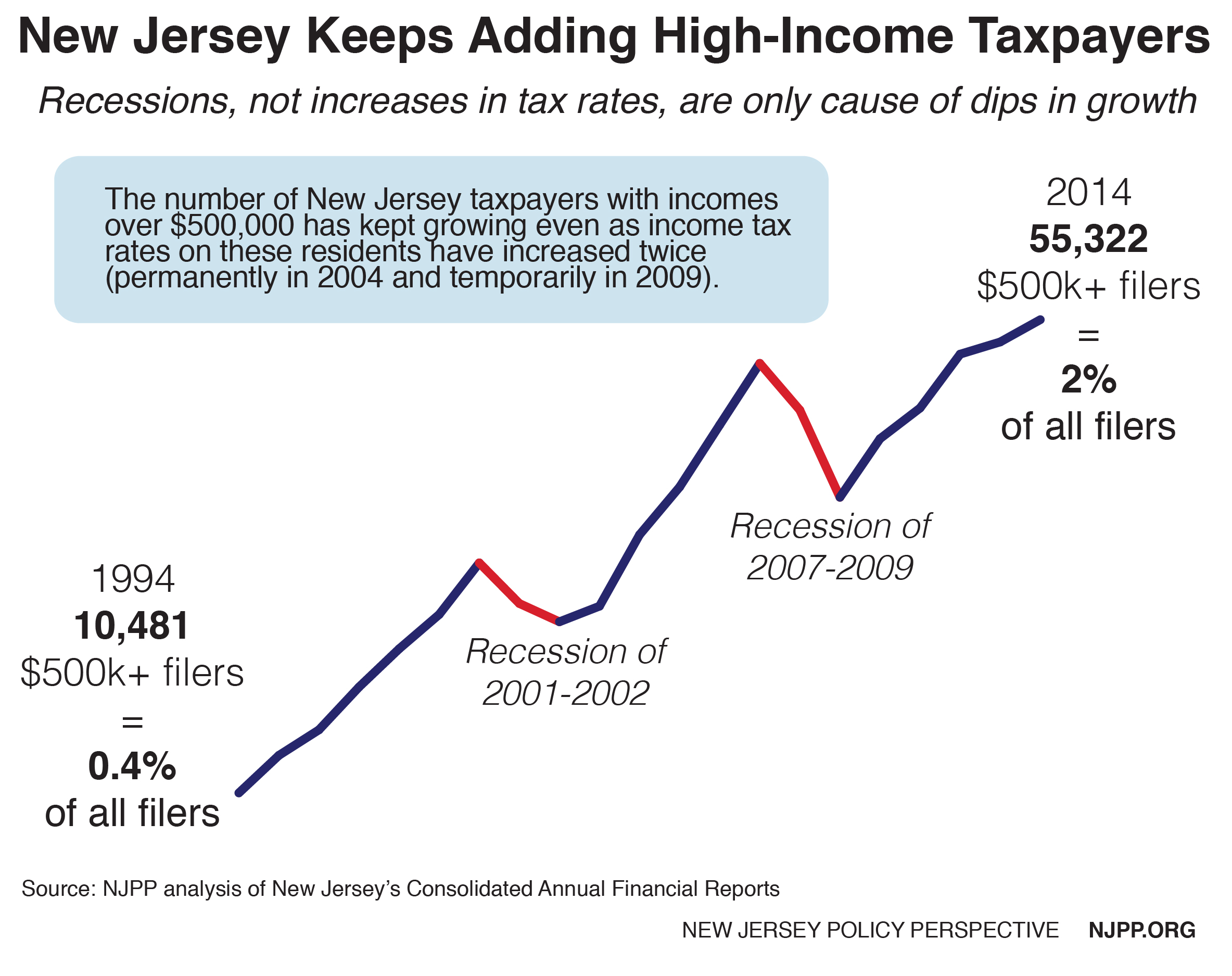

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

2021 State Corporate Tax Rates And Brackets Tax Foundation

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

2021 New Jersey Payroll Tax Rates Abacus Payroll

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants